By Chintan Haria,

Understanding Low-Volatility Investing Options

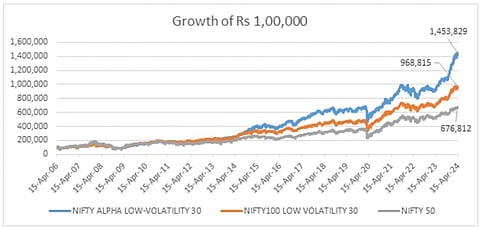

Historical data shows that over the long term, low-volatility offerings have managed to outperform market cap-based indices. This outperformance was possible due to downside protection.

In today's world, investors are increasingly seeking out options which will not only help generate reasonable returns but also keep volatility and its impact at bay. Since investors are volatility-averse, investors are increasingly opting for low-volatility-based investment products. Investing in low-volatility offerings has many advantages. Historical data shows that over the long term, low-volatility offerings have managed to outperform market cap-based indices. This outperformance was possible due to downside protection.

Typically, less volatile stocks tend to experience relatively minimal losses during market downturns compared to their other counterparts. Recovering from these losses is easier with less volatile stocks because it takes a smaller gain to return to the original level. On the other hand, highly volatile stocks would require significantly larger gains to bounce back from losses, especially as the scale of the loss increases. For instance, a 10% loss only needs an 11.11% gain to break even, while a 50% loss requires a doubling of value just to return to its initial sum. Therefore, the lower the volatility, the lower the potential loss, making it easier to recover and potentially earn gains.

Low-Volatility Investment Options

There are two ways for investors to take exposure to a Low volatility-based offering - Index Funds and Exchange-Traded Funds (ETFs). These are investment vehicles designed to provide investors with exposure to a portfolio that mirrors the underlying index.

Both index funds and ETFs offer investors an efficient and cost-effective way to gain exposure to a diversified portfolio of assets. Index funds are just like any other mutual funds, wherein investors can invest directly through the AMC. One can initiate a lump sum or an SIP in an index fund. On the other hand, ETFs function like an index fund but the units of the same are listed and traded on the stock exchanges like individual stocks throughout the trading hours, providing intra-day liquidity and flexibility. Given the nature of the ETF, one required a Demat account to buy and sell units of an ETF.

Types of Low-Volatility Investments

Nifty 100 Low Volatility 30 TRI: As the name suggests, this index comprises of 30 least volatile names from the Nifty 100 universe. The index is periodically reviewed and the stocks which do not meet the criteria are removed and newer ones are added. As a result, the offerings based on this index tend to deliver stable returns and the volatility associated is minimal.

Nifty Alpha Low Volatility 30 TRI: The index is designed to reflect the performance of a portfolio of stocks selected based on a top combination of alpha and low volatility. In effect, the index will consist of 30 stocks selected from Nifty 100 and Nifty Midcap 50 universe with low volatility and good returns. The weightage of the stocks is derived from Alpha and Low Volatility factor scores with individual stock weight capped at 5%.

Where to invest?

In each of the offerings, consider the selection universe. When it comes to Nifty 100 Low Volatility 30, the focus is on the large-cap universe. On the other hand, in Nifty Alpha Low Volatility 30, there is an element of exposure to midcaps as well. So basis the portfolio composition, conservative investors can consider Nifty 100 Low Volatility 30 and moderate to aggressive investors can consider Nifty Alpha Low Volatility 30.

At a time when uncertainty is the byword, equity exposure through low volatility-based offerings can be an interesting addition to one’s portfolio. To understand the product fit better, it is best to seek the advice of a professional financial advisor.

(Disclaimer: The author is Principal- Investment Strategy, ICICI Prudential AMC. Views expressed are personal and do not necessarily represent the official position or policy of the outlook Media Group or Its employees. )