Consumers of financial services products are increasingly shunning distributors and agents. While going direct can be cost-effective, Malini Bhupta and Preeti Kulkarni highlight some of the challenges that come with this behavior

Should You Go Direct

Consumers of financial services products are increasingly shunning distributors and agents.

The financial services business is witnessing a silent, but decisive shift, in consumer behaviour. Thanks to the rapid rollout of high-speed mobile broadband services over the last two years, Indians are increasingly looking at investing and buying financial products directly from companies or through other digital channels. Disintermediation is a reality that is playing out in India as well, with the Millennials preferring to transact without the involvement of distributors or agents. Be it mutual funds or insurance, Indians are now expressing a desire to cut out the physical intermediaries because of an inherent belief that distributors tend to have a commission bias, which is why they only push products that help them earn more.

Direct plans are now gaining currency as a lot of high networth investors (HNI) are reluctant to pay 2.5 per cent commissions to distributors. The market regulator, Securities and Exchange Board of India (SEBI), mandated in 2012 that all mutual fund schemes should offer direct plans. These plans come with an expense ratio that’s as low as 70 basis points compared to 2.5 per cent charged by regular schemes. Says Aashish Somaiyaa, CEO of Motilal Oswal Asset Management, “In six years, data shows that there is a gradual shift towards direct plans as many large investors are choosing direct plans and paying advisory fees to distributors.” Paying a commission of 2 per cent may not be much for a retail investor investing `1,50,000 a year, but the commission adds up to a substantial sum if the investor is putting in `1 crore a month, as many HNIs do. Explaining the rationale behind direct plans, Kunal Bajaj, CEO and co-founder of Clearfunds, says: “Direct plans are for high networth individuals who have the ability to pay their advisors or wealth managers a flat fee for this service.” However, they might still need human intervention for procedural matters. For example, completing know-your-customer (KYC) processes or resolving procedural and technical glitches.

Even though distributors and asset management companies would like investors to believe that commissions don’t impact returns for small ticket investments, over the long term, commissions also compound and dent the final corpus. Explains certified financial planner, Shweta Jain, “Direct plans are not only for HNIs or those who do not need hand-holding. The difference in expense ratios of direct and regular plans may seem small, but over a period of say 10 years, the effect of compounding will make a huge difference to the corpus.” (See: Direct Vs Regular)

She always recommends direct plans to prevent corrupt manufacturers from influencing her recommendations. Since there is no commission element involved, investors are unlikely to face mis-selling for such plans.

While the reluctance to pay higher commissions through regular plans is pushing investors towards direct plans, the ease of doing

business online is what is

driving the insurance customer to go direct. The shift to direct channels has been far more pronounced in insurance because it is a transactional product. According to a report by PwC on the insurance industry, 20-25 per cent Indians are now using digital channels to understand and compare insurance products. Another research shows that 90 per cent customers research term insurance plans online. Explains Yashish Dahiya, co-founder and CEO, Policybazaar: “The digital customer wants convenience and doesn’t like the delay in either policy processing or issuance. Through our digital solutions, we have been able to cut down the delay from two days to two hours.” On the policy document front, the customer gets it instantly in the digital space compared to the physical space where he/she gets a cover note at the time of purchase followed by policy copy over next few days.”

Even though experience in some developed countries suggests that moving investments online is not easy, the mutual fund industry here is seeing a rapid rise in direct investments. Direct investments (direct plans, which come with lower expense charges and where the investor invests directly through the AMC), amount to 14 per cent of individual assets today, Association of Mutual Funds in India’s (AMFI) data shows. Nearly `600 crore, which is close to 10 per cent of monthly flows through the systematic investment plans (SIP) are going into direct plans. No wonder, the vast army of mutual fund distributors and insurance agents is a worried lot today. Intermediaries are staring at a reality where their customers may not need them anymore.

While technology is a big driver of this shift, distrust among consumers for the neighbourhood distributor is another reason why a lot of consumers are preferring technology platforms over human intermediaries. Also, a lot of information today is now available online at the click of a button. In the pre-internet era, the key disseminators of information were distributors, banks and agents. But now there are a host of digital platforms like fundsindia.com, policybazaar.com and online investment apps like Scripbox, providing both easy access to information and investment options to consumers. Explains Rakesh Jain, CEO of Reliance General Insurance, “Structurally, we are moving from an information arbitrage system to information available system. The brick-and-mortar model with feet on the street is now in the past. All intermediaries need to evaluate and understand the shift in consumer behaviour, which is why agents are getting into the advisory role.”

Be it lenders, insurance companies or asset management companies, almost every player in the financial services space is looking at engaging with the customers directly. While the share of direct participation in mutual funds stands at 14 per cent (retail), the share of direct is much higher in the insurance space for some large players. Reacting to this trend early on, Aegon Life decided to do away with the agency business altogether two years ago. “We were the pioneers in the online term insurance space and decided to take a step ahead by focusing on our direct channels, comprising the digital platform and in-house teams. Customers’ comfort with digital is growing and we have seen our online sales for term products grow three times since the strategic shift in 2016,” explains Vineet Arora, MD and CEO, Aegon Life Insurance, which offers online products across term, health, endowment and Ulip categories, with term plans being the most popular of the lot. The insurer boasts of a term cover share of 60 per cent in its portfolio, while the category accounts for three to five per cent of other insurers’ business mix. “While the market for pure protection products has grown over the years, the launch of low-cost online Ulips has added an impetus to the commercial opportunity available. There is a visible inclination among customers towards buying products online,” says Anuj Mathur, CEO, Canara HSBC OBC Life Insurance, adding that the Insurance Self Network Platform guidelines will further lead to more customer-centric solutions being offered through the online platform. Most insurers that Outlook Money spoke to said that while their agency business was growing at 20 per cent year-on-year, the business through the direct channel was growing at more than 50 per cent year-on-year.

The asset management business, on the other hand, has remained relatively tight-lipped about the direct channel, even though they are investing heavily in their direct channels, for fear of angering their base of distributors. But the writing is clearly on the wall. Consumers are expressing a keen interest in doing away with the conventional distributor channel because of a trust deficit. The question is: Should consumers go direct? Outlook Money brings to you the pros and cons of going direct.

Investing directly in mutual funds: low cost option but risky

The disruption in the mutual fund business is apparent from a multitude of distribution channels that exist today. While players like Scripbox and Sqrrl offer regular plans to first-time investors beyond the top 15 cities of India, other players like Clearfunds, Unovest and Investza offer direct plans to investors on their platforms but charge them an advisory fee. These platforms are currently catering largely to HNIs. But they are giving the existing distributors the jitters. Making this more interesting are advertisements by players like UTI AMC, inviting investors to invest directly through their website.

So the question to ask is what is the best way to invest in mutual fund schemes?

Affluent investors, who are better informed, are now investing in direct plans offered by all mutual funds. Even if they are opting to go through the distributors, they are unwilling to pay a higher commission. So they are paying for advisory but choosing direct plans, which have lower charges. Explains Sundeep Sikka, Executive Director and CEO of Reliance Nippon Life Asset Management, “The market is going to evolve. Right now, 2 per cent of India invests in mutual funds. It is important to understand that multiple distribution models will exist.” But is direct investing for all investors? The answer is a clear no, even if retail investors prefer to invest digitally and not through the neighbourhood distributor. Investors need to have knowledge and equanimity. “A third party might be required to moderate the bias and take dispassionate calls basis your needs. They can help you avoid the cycle of greed and fear,” points out Suraj Kaeley, group president, sales and marketing, UTI AMC, adding that his company is agnostic to regular and direct plans.

A key issue facing the asset management business is the deficit of trust. Explains Ashok Kumar, CEO and co-founder of online investment services provider Scripbox: “Nobody wants to talk to a human being to get things done today. This is a big shift that has happened because of a trust deficit among investors, as they believe there is a commission and manufacturer bias in distributors today. Also, today you cannot push people to do things. Over time, too much of mis-selling has happened. Also, people like to self-discover.” A lot of first-time investors are

comfortable investing through online platforms like FundsIndia, Scripbox and Sqrrl—even if they offer regular plans that charge higher commissions—because they don’t trust their banks or mutual fund distributors.

Some asset management companies claim that they are building a direct channel because they wish to cut the clout of large distributors who often hold the AMC to ransom because of the sheer volume of business they bring. Distributors, on the other hand, claim that the asset management companies have not always played fair in a bid to shore up AUMs (assets under management) and have themselves to blame for the lack of trust among investors.

While direct plans are available to investors and many are even choosing that route, investors need to keep in mind that a high rating does not guarantee long-term performance. Typically, most investors look at a fund’s performance over a shorter duration and then invest. This can lead to problems, claim many distributors. Says Jimmy Patel, CEO of Quantum AMC: “Retail investors are seen relying on information available in the public domain like the ratings and rankings to invest via the direct route. There is a higher likelihood of an investor investing without completely understanding the requirements. This has happened in developed markets, where investors invested via direct route, banking on information they could get their hands on or just mere hearsay.” Investing directly comes with a caveat, “Buyer Beware.”

Despite this shift in consumer behaviour, many still believe that the consumer needs advice before investing and, therefore, the distributors, digital platforms and direct channels (AMCs and independent platforms hawking direct plans) will co-exist. Kumar of Scripbox believes that consumers are willing to trust digital platforms because they want assistance, even if they invest through a technology platform. The online investment platform helps investors select funds using algorithms and even helps the investor move out of the mutual fund schemes if they are not delivering good returns after one year.

Given that no two funds perform alike in different market cycles, choosing the right fund becomes very important. Choosing a wrong fund can seriously impair wealth creation goals. The high net worth individuals are no longer willing to pay 2.5 per cent in commissions, claim distributors. For instance, direct investment platform Unovest has a small investor base of 3,500 but has helped investors invest `400 crore through its platform. Motilal Oswal Asset Management’s Somaiyaa believes that if everything goes direct, then new models will need to evolve. Over time, regulators could consider variable charges for different share classes. For instance, in the US, the expense ratios depend on the size of investments made. A small-ticket transaction can attract a higher expense compared to a large investment.

But the writing is on the wall and even traditional distributors are now responding to the change in customer behaviour. NJ India Invest—one of India’s largest mutual fund distributors that manages assets worth nearly `50,000 crore —is also transforming itself. NJ India Invest has completely gone paperless and now helps investors invest through its platform. But this is assisted investing where a distributor is associated with every transaction. Says Neeraj Choksi, co-founder of NJ Invest, “We have an electronic platform through which customers can buy multiple schemes. On the platform also there is a physical intermediary who helps the customer choose funds. We have 25,000 distributors on our platform and they acquire customers. The on-boarding process is electronic. Our intermediary can generate a link and through that the customer can make a payment.”

But over time, distributors will have to significantly add value if they want to retain customers, claim industry experts and digital participants. Those who cater to the retail customers will need to build serious scale if they need to have a large number of investors as clients to remain viable. A big shift in consumer behaviour will be when Millennials cross 30 years of age. Most intermediaries and fund houses believe that the adoption of direct plans will sharply go up at this time because this generation prefers to cut out human intervention. In order to stay relevant, they will have to offer more value to customers. Bajaj of Clearfunds, a platform that only hawks direct plans of mutual funds, says: “Once you realise that buying a regular fund means that you end up paying a regular part of your earnings each year to your distributor, you will immediately look for an alternative—direct plans of the same mutual fund scheme. A large number of HNIs and almost all corporates already understand that direct funds mean more money for them rather than their bankers, brokers and wealth managers. We see the shift to direct plans taking place just like the adoption rate of Exchange Traded Funds (ETFs) in the US—slowly at first, then all at once!”

Regulation is also seeking to split advisory from distribution. Recently, SEBI released a consultation paper that proposes a clear demarcation between investment advisory and distribution of investment products. The objective is to “prevent the conflict of interest between ‘advising’ of investment products and ‘selling’ of investment products by the same entity or person,” the note said. If these proposals materialise and are implemented in spirit, it will ensure peace of mind for retail investors, who otherwise assume that distributors’ recommendations are guided by their commissions, and not need-based analysis. “While SEBI’s proposed move is aimed at eliminating the potential conflict of interest between the advisory and distribution roles played by the same or related entities, it could have far reaching implications on how the market for mutual funds and the related ecosystem are structured,” says Sai Venkateshwaran, partner and head, accounting advisory services, KPMG in India. He reckons that if implemented, the proposal will force many players to alter their business models. “Some of the larger distributors might continue with the distribution business as compared to advisory services, as there may be relatively lower number of fee-paying clients. Entities that decide to continue or enter into advisory services will see a shift towards fee-charging model, to compensate for the loss of trail commissions earned on distribution of the products,” he adds. However, the fee-based model hasn’t evolved and the market is yet to mature. “As a result of these changes, there may also be a shift of investors towards direct funds as compared to regular funds,” says Venkateshwaran.

Intermediaries will have to make a choice between being an investment advisor and a mutual fund distributor before March 31, 2019. What’s more, distributors will be barred from offering advisory services through immediate relatives—spouse, parents, brother, sister and children —if the proposals are finalised in their current form. “We will see registered investment advisors (RIA) selling these plans and charging a fee. Once SEBI finalises these guidelines, the direct segment will get a push,” predicts Kaeley of UTI AMC.

Insurance – traffic shifts to assisted direct and direct platforms

Globally, shifting investments online has not been an easy process. But the journey has been relatively easier for the insurance sector because customers like choice. The open architecture model of digital platforms allows customers a lot more options while buying insurance, which is not the case while buying insurance through a traditional channel. When consumers go to digital platforms, they can compare features of products from different insurers. Also, under existing rules, banks are allowed to only partner with up to three insurance companies in each category (life, general and health), which is restrictive for customers. Moreover, some banks with insurance subsidiaries have stayed away from distributing other insurance companies’ products.

Over time, customers of insurance have learned to not only research for products online but also purchase them digitally. Also, digital platforms have helped companies issue policies at a much faster pace than the traditional channels. This puts at risk an army of 20 lakh insurance agents across the country.

The shift to direct or assisted direct channels is best told through data. Direct business for private life insurers increased from `758 crore in the April-June period in FY18 to `942 crore in July-September quarter of FY18, which shows a 24 per cent growth sequentially. The online motor insurance market has also grown by 50 per cent this year compared to last year and is further expected to grow by 100 per cent in 2018, claim research reports. Most insurers claim that traffic has increased three times on their websites compared to last year. The digital channel also allows more flexibility to insurers to grow their business. Says Deepak Mittal, CEO and MD of Edelweiss Tokio Life: “Thanks to the digital channel, insurers can now reach customers with a central suite of products. Distribution is not open in the physical world, as it is in the digital world. Achieving scale in the digital world is easier and, therefore, growing market share too is easier and faster in the digital space.”

Insurance, historically, has worked on a catchment area and focused on local areas. Like India’s IT industry, the growth of its business was linked to the number of feet on the street. But with customers preferring to shop online for insurance products, companies are now investing more in marketing spends to build their connect directly, rather than spending money on their sales force alone. Explains Subrat Mohanty, senior executive vice-president and head of strategy, HDFC Life: “Consumers get a mix of price advantage, convenience and control over the purchase journey. In case the customer needs any assistance, that is also provided without the need for a face-to-face-meeting.”

Numbers only strengthen the case of digital sales in insurance. Nearly 95 per cent of ICICI Prudential Life’s new business applications in the first half of financial year 2017-18 were logged digitally. Says Puneet Nanda, Executive Director, ICICI Prudential Life Insurance: “To provide an additional layer of convenience to our customers, we have, since June 2017, begun issuing policies on the basis of biometric authentication. This process is completely paperless and enables us to issue (non-medical) policies in less than 20 minutes.” A big reason for this is the speed to market and customer data that gets captured online.

Invaluable customer data is gathered by an insurer when customers reach out to them directly. “The direct mode ensures full transparency and control for the policyholders. As insurers, we get to do more customer-oriented research, understand them better and offer more relevant solutions suited to their needs,” says Arora of Aegon Life.

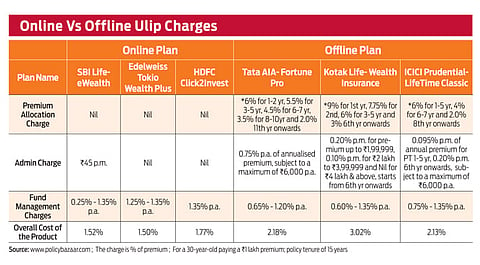

The barrage of customer information that comes through digital channels is also helping insurers design products that are based on needs of the customers. For instance, insurance companies have found it hard to sell unit-linked products, as they are market-oriented like mutual funds, but come with a lock-in and higher costs. Taking this feedback, insurers such as Edelweiss Tokio Life worked on a product like Wealth Plus, which gives the investor better returns. The life insurer is trying to redefine this space by addressing pain points of customers. So its new product, is more customer-centric, the insurance company claims.

Wealth Plus is a plan designed for digitally-savvy customers. Edelweiss Tokio Life has not only done away with premium allocation and policy administration charges, but furthermore, decided to contribute additional units on every premium paid by the customer. These additional allocations start at one per cent for the first five years and then increase every five years to three per cent, five per cent and seven per cent, thereby, accelerating one’s wealth accumulation, while also offering protection at the same time. The product has been created in conjunction with Policybazaar, an online marketplace for insurance. Explains Dahiya of Policybazaar: “Companies have understood the behaviour of new-age digital consumers and worked on the products matching their requirements, leading to exponential growth of the industry.”

The innovation drive

Insurers have come up with other innovations for customers over the last few years. For example, whole life and return of premium term plans were launched after customer feedback suggested that they were unwilling to pay premiums for products that do not yield any returns. These plans do not come with high premiums or exorbitant commissions and other charges unlike other investment-cum-insurance plans, but ensure that the policyholder gets her capital back at maturity—a feature that regular term plans do not offer. Life insurance companies also introduced online Ulips for customers who saw huge commission payout as a red flag.

General insurers too have upped their game for managing expectations of the new breed of tech-savvy customers. For instance, last year, ICICI Lombard rolled out a video inspection feature that allows customers to raise an instant claim request through the company’s mobile app. Once the policyholder streams a live video of the damaged vehicle to the company’s claims manager, the damage will be assessed and customer will receive intimation about the extent of liability. If the insured accepts the assessment, the claim will be approved instantly. Likewise, Bajaj Allianz General Insurance launched an app-based claim settlement facility for its motor insurance customers, which allows them to upload the pictures of the damaged vehicle through its app for instant claim processing. If customers accept the recommendation, the claim is credited to the insured’s bank account within 30 minutes, according to the company. “Technology is reducing the need for physical inspection and documentation and, thereby, bringing down the time taken in claims and query management,” says Tapan Singhel, MD and CEO, Bajaj Allianz General Insurance.

Clearly, the digital channel is here to stay, and grow bigger and stronger. Retail investors must look at the direct mode to gain from the inherent benefits like lower costs and transparency, but at the same time, carry out a thorough analysis of products best suited for them before clicking the ‘Buy’ button.

Interview

Direct Plans Are For The Savvy

Sundeep Sikka explains to Malini Bhupta why multiple channels will co-exist in the future, even though direct investments are picking up

Is the Indian consumer more inclined to invest directly in mutual funds now?

In India, financial literacy and penetration levels of mutual funds are at a nascent stage. Intermediaries, therefore, play a pivotal role in helping investors make wise investment choices. Having said this, with increasing awareness and evolving investor base, savvy investors have started transacting directly. So, while there will be a set of investors who need advice, there are those who invest directly.

The customer today does not trust the distributor. How are fund houses responding to that?

A distributor constitutes a very important link between the AMC and an investor. A distributor helps the investor identify the right investments based on suitability. After all, each investor is different in terms of risk appetite, time horizon and financial goals.

Today, millions of Indian investors are benefitting from the wealth AMCs have created, all thanks to the distributor community. There may have been handful of distributors whose practices were not investor-friendly, but in the long run, they would be rewarded only for right service and true advice.

Are direct plans becoming popular?

There is no doubt that direct plans will gain currency and asset management companies will have to embrace technology. For instance, 18 per cent of our incremental equity inflows come through the direct channel. Today, high networth individuals and corporate entities prefer to invest in direct plans as they are capable of making informed decisions.

While expert investors may invest in direct plans on their own entirely, the investors who are yet to evolve in their investment learning should prefer the regular route.

What about the role of advisory? How important is it?

Advisory will evolve in India, as it has in other markets across the globe. Presently, the distribution and advisory are not segregated. There is a regulatory push to split them in order to protect the interest of investors. Such an arrangement would lead investors to invest based on advice.

As the investors evolve, they will start valuing the importance of high quality advice; they will not shy away from paying a fee for the same. Furthermore, as the markets deepen, ultimately all industry stakeholders will benefit from true advisory.

What kind of investors should invest in direct plans?

Only savvy investors who have a complete understanding of the sectors and markets should invest directly into schemes. Wrong investment decisions can have severe consequences. ‘Buyer beware’ is the message for those investors looking to invest directly into schemes. Also, in case of investing, there is no ‘one size, fits all.’ Different sets of investors should follow different strategies.

Given the changes in consumer behaviour, what is the road ahead?

We are seeing investors mature in their investment decisions over a period. In the past, there was a broad-based tendency to get carried away with market movements. Today, investors are entering capital markets with longer-term horizons and looking to invest in schemes with a track record of 15-20 years. Even HNIs have graduated in their investment choices. Understanding that alpha generation in large-caps is declining year after year, HNI segment is seen moving towards passive products like ETFs.

Also, 20 per cent of our incremental business comes through digital properties, which not only includes direct transactions, but also distributor initiated accounts.

Interview

Advisors Can Generate Alpha

Neeraj Choksi and Jignesh Desai of NJ Invest, one of India’s largest mutual fund distributors, explain to Malini Bhupta why distributors will always be relevant

Do you see change in consumer behavior?

Choksi: There has been a huge inflow of money, which is because of distributors and their advisory services. Customers don’t even know the difference between debt scheme and equity schemes. Advisories globally have generated huge alpha compared to those investing directly. These instances are to be seen in India too. We continue to believe that the role of an advisor is very important in financial services. When things are good, everyone moves in a direction but just when there is a turn, then people who go direct get lost. It is the distributor who manages the behavior of the consumer.

We don’t see any behavioral change. Some people do get greedy and they try to save on commissions by going direct, but there is no guarantee on whether they are equipped to take a decision.

Do customers want to cut out human intervention?

Desai: The ease of operation is driving customers. I don’t see that as a behavioral change. It is convenience that the customer is seeking. Statistics show that majority inflows are coming through distributors. If you look at small investors, the SIPs are routed through distributors. In any market, 10 per cent always comes through direct route. So, while the direct market is growing on one hand, the overall market is also growing because of distributors.

Why are mutual funds investing in direct channels?

Choksi: The market regulator has mandated that mutual funds must have direct plans. Also, the expense ratio should be lower for such plans. The change that has occurred is that people are buying electronically and the trend will grow further. But, the belief around distrust for intermediaries is not true.

We have an electronic platform through which customers can buy multiple schemes. However, on the platform also there is a physical intermediary who helps the customers choose. We have 25,000 distributors on our platform who acquire customers. Once a customer has been acquired, the on-boarding process is carried out electronically. Our intermediary generates a link through which the customer can make a payment. We also have an app, which is linked with the intermediary.

Everything is being done online and we are not accepting any physical applications. All clients are transacting electronically but there is an intermediary to help complete the transaction. The change is that earlier this interaction was happening physically and now it is carried out electronically. This shift has led to cost savings.

Do you offer direct plans on your platform?

Choksi: We don’t offer direct plans as we don’t get paid for it. Direct plans are for those who don’t want an intermediary. For our portfolio management services (PMS) products, we offer direct plans. We have 1500 plus clients for our PMS and the ticket size is `25 lakh.

What is the downside of going direct?

Desai: The advisors are helping those investors generate alpha who are seeking the advisory route. Investors going through intermediaries are able to get higher returns, as the intermediaries help take decisions which are not based on emotions. The role of intermediary will never diminish.

A Host Of Distribution Models With Varying Charges Are Now Available To Investors

Time To Pay For Investment Advice

Mutual fund’s distribution and advisory role should be separated, says a SEBI report. By Juhi Kapoor

In a country where a mere 10 per cent of the population invests in the equity market, rampant mis-selling of financial products to investors who are already risk-averse, can be a growth dampener to the entire industry. A wrong financial product can cause a huge dent in the investor’s faith in capital markets.

Mis-selling is attributed to the industry’s commissions-driven way of doing business. Financial advisors and distributors are known to recommend products with higher commission, instead of, offering something that suit their clients.

To prevent conflict of interest in future, the Securities and Exchange Board of India (SEBI) had revised the 2016 Investment Advisers Regulations. This month, it released yet another consultation paper.

Advise, don’t sell

The latest paper suggests that registered investment advisors shall not provide distribution services directly or through their immediate relatives. Similarly, registered distributors shall not provide investment advice on any financial product directly, or through their immediate relatives.

At the institutional level, banks, non-banking financial corporations, limited liability partnerships and firms that wish to register as investment advisors shall not offer any distribution services directly or through their holding company, associate or subsidiary. Institutional distributors will not be allowed to provide investment advice directly or through holding company, associate or subsidiary.

The regulator has defined an associate company as an entity in which the body corporate or its director or partner holds, either individually or collectively, more than 15 per cent of paid-up equity share capital or partnership interest.

Individuals and institutions that offer both advisory and distribution services shall be required to choose between the two before 31 March 2019. From 2020, any person, including their relatives or holding/subsidiary/associate entity, shall offer either investment advice or distribution services.

The paper also proposes to allow distributors to explain product features to clients according to the principle of ‘appropriateness’—which is selling a product best suited to the client. Distributors will be required to disclose the mutual funds they are affiliated with.

Mixed reactions

SEBI’s suggestions have received mixed responses. Some believe that the proposed changes will act against investor interest, others have adopted a more neutral stance.

“The proposed regulations will harm investors as they rely on distributors to recommend products. There can be no sale of a mutual fund product by a distributor without some element of advice,” said Dhruv Mehta, chairman of Foundation of Independent Financial Advisors.

The proposed regulations will increase paperwork, decrease efficiency and will add to costs. Distributors will have to maintain disclosure records liable to possible audit, according to Akhil Chaturvedi, executive vice president and head of sales and distribution at Motilal Oswal Asset Management Company.

Moreover, investors won’t be able to access financial advice and products under one roof unless they come from corporate advisory entities, in turn hurting small-time distributors. A typical mutual fund value chain relies on its distribution partners. The sales force of an asset management company builds partnerships with large distributors who acquire investors. This network will get dislocated.

“We are in an industry, which has not been able to penetrate as much, with two crore unique investors in a population of 130 crore people. It’s difficult to visualise how the industry will expand in the absence of a vibrant distributor network,” Chaturvedi added.

A zero-sum game

Shifting from a commission-based to a fee-based model is expected to be challenging for financial advisors. The only way a financial advisor can make money is by eating into the customer’s returns. “Indian investors are often reluctant to pay advisory fees. It will take time before they get comfortable with the idea,” said one distributor.

As mis-selling is often attributed to the industry’s mis-aligned incentive structure, stakeholders believe that the industry’s variable pay structure needs to be transformed to suit the investors’ interest. “The focus should be on improving education standards. Professional courses like CFP (Certified Financial Planner) should be encouraged, so that distributors are trained to offer financial solutions,” said Chaturvedi.

If you’re an investor

You should know that your current financial advisor or agent may not be able to continue offering advice and products at the same time, unless you are dealing with a corporate advisor or financial institutions, such as, banks, non-banking financial companies and corporate advisors.

If you believe you can manage your investments without external advice, then consider investing in mutual fund schemes’ direct plans through asset management companies (AMC) online modes. The investment process can be wearisome.

If your portfolio is large, and if you require a person to execute your investment transactions and handle paperwork, then consider purchasing your products directly through a distributor. A distributor is required to disclose the details of his commission structure from asset management companies. This way, you can check for conflict of interest before choosing your mutual fund schemes.

For advice, visit a registered advisor who will gauge your risk profile and life goals before recommending a financial plan.

When browsing websites, ask a financial planner for a detailed break-up of their charges and look for their official qualifications.

It’s A Popular Myth That Insurance Products Cannot Be Sold Online

Aegon’s business model has been transformed by selecting a distribution model that is customer-led and leverages technology

When customer expectations evolve as fast as digital technology does, companies have to respond quickly or lose their competitive edge. That means creating and adopting a digitally-enabled business model, which allow us to service customers the way they want—whether it is online or offline.

That makes our “customer first” strategy, powered by technology, the appropriate one. Surveys clearly indicate that with the increase in the number of smartphones, the number of internet users is also growing exponentially. Surveys suggest that there were over 460 million internet users in India in June 2017, and that number is growing at 35 per cent annually.

Changing customer behaviour, where customers want to make their own choices through digital empowerment, combined with a 92 per cent life insurance protection gap, there is a huge opportunity in going directly to the customer. So, we did.

The transition phase had many elements, beginning with aligning the organisation’s structure to the direct-to-customer strategy. Then, we built the relevant capabilities and incubated a culture that also aligns to the strategy. It is a journey, and it is ongoing, because culture and capabilities also evolve as we grow.

During the transition, we stayed connected to customers with meaningful initiatives like ‘iWill’, where they could create their Wills in a document we provide, and ‘iCare’, which served like a one-stop financial information repository for use by family members or the nominee in case of any eventuality.

The transition was made easier because of the deep understanding of the online protection business. Aegon Life is the pioneer in the online protection space; we launched our first online protection product in 2009. Hence, we could digitise the journey for the customers with much ease, reduce bottlenecks and create seamless process for issuance.

A big part of the life insurance business is also about claim settlement. Thinking about our strategy from an outside-in perspective places customers at the centre of our universe.

Our claim settlement ratio has been growing steadily and is at a high of 97 per cent. This is a reflection of how reaching out directly to consumers impact the quality of business.

We assigned specific points of contact (SPOCs) to engage with our customers. For locations where our direct-to-customer channel was present, we introduced our own relationship managers to service them seamlessly. Our constant endeavour is to facilitate a smooth journey, be it with an easier-to-navigate website or by empowering our offline sales with digital tools.

Our transition was propelled by co-creation. Vision and values formed the foundation of how to achieve our strategic imperatives. Here’s what that achieves: customers are empowered to make their own choices. They can buy online or choose to meet a relationship manager in person.

Our customers are happy with our strategic shift. We are seen as a new-age, digitally powered life insurance company. Most importantly, the initiatives we undertake are driven by customer insights using design-thinking principles.

Customers are looped in on all communication in a transparent manner. During the transition, we moved out of some locations where we had branch presence, but kept our communication proactive and ensured that we responded to all their queries and concerns to their satisfaction.

How do we know our customers like what we have done? Look at our net promoter score (NPS), a measure of customer loyalty between -100 (where all customers are detractors) to +100 (where all customers are promoters). It’s a metric adopted by two-thirds of the Fortune 500 companies globally. Aegon Life scores +46 per cent, on a scale where +50 per cent is considered excellent.

It’s a popular myth that insurance cannot be sold online; by choosing a distribution model that is customer-led and leverages digital technology, we have laid that myth to rest.