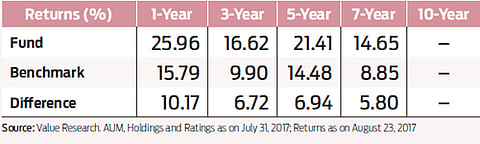

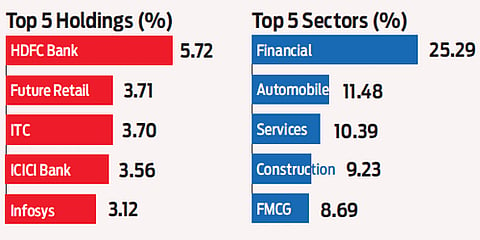

This fund started on the wrong foot in 2008, but it has since then earned its stripes among other tax planning funds with its consistent performance. A relatively small corpus allows the fund manager to allocate a higher proportion to mid and small-cap stocks, which have added to its returns in recent years. A very actively managed fund, the portfolio of the fund has over 60 stocks, which further brings in the much needed diversification.

Strong growth: IDFC Tax Advantage

The portfolio of the fund has over 60 stocks, which further brings in the much needed diversification

Advertisement

The fund manager follows a growth-at-a-reasonable-price approach to stock selection by identifying companies based on their growth potential and future prospects. The only flipside of investing in this fund is the fact that it is yet to face a beat phase of the market, but in years like 2011 and 2013, it did manage to fare well despite any significant moves in the markets. This is a slightly risky fund among the ELSS category to invest in, but worth every bit if you are looking for more than usual returns.

Launch Date: December 17, 2008

Fund Manager: Daylynn Gerard Paul Pinto

Benchmark: S&P BSE 200 Index

Expense ratio: 2.39

Show comments

Published At: