When it comes to tax savings, most people blindly choose an instrument without realising how it will find a fit into their financial lives. A smart way to optimise tax savings is to integrate it with one’s financial goals and choose tax saving instruments which will work effectively. One such instrument that stands out when it comes to saving taxes is mutual funds.

Save tax wisely

Mutual fund is a financial instrument in which you can park money to save tax

Equity linked saving scheme (ELSS)

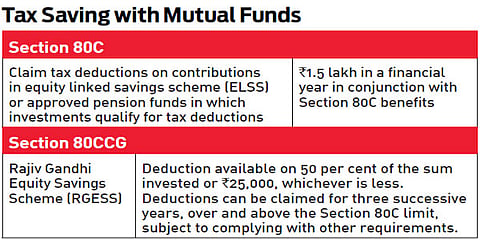

ELSS is a mutual fund scheme in which investments qualify for tax deductions under Section 80C of the Income Tax Act up to Rs 1.5 lakh limit. Moreover, the ELSS has a three-year lock-in, which is also the shortest lock-in period among all the tax savings option. On completion of the lock-in, the redeemed sum does not attract any tax.

Retirement plans

There are some mutual fund schemes in which investments are towards retirement savings that qualify for tax deductions under Section 80C of the I-T Act up to Rs 1.5 lakh limit. They have an exit clause, wherein the investor can exit when they turn 58.

RGESS

Rajiv Gandhi Equity Savings Scheme or RGESS was introduced to motivate small investors to invest in the domestic capital markets. The tax deduction in terms of RGESS guidelines is offered to a new retail investor who complies with the conditions of RGESS and who have a gross total income not more than or equal to Rs 12 lakh for the financial year in which the investment is made under RGESS.

The investment should be made in listed equity shares or listed units of equity oriented mutual fund. Investors who qualify are eligible for 50 per cent deduction of the amount invested or Rs 25,000, whichever is less. Investors who qualify are eligible for a 50 per cent deduction of the amount invested from the taxable income of that year under Section 80CCG. The investment is locked-in for three years and the benefit is over and above the deduction available under Section 80C.