Good EMI’, ‘Jo samjhega, wo hi payega’ or ‘What’s your number’ are all high recall mutual fund advertisements thanks to their easy connect with investors—old and new. The spate of campaigns by mutual fund companies in recent years has somewhat managed to strike a chord with investors, who are now far more drawn to investing in mutual funds. Today, SIPs or systematic investment plans are to mutual funds what Xerox was to photocopying. The draw of SIPs can be gauged by the rise in the active number of SIP accounts, which now is touted to have crossed the one crore mark.

Rising SIP book

With the continuing confidence of investors in Mutual Funds, Investments soar up

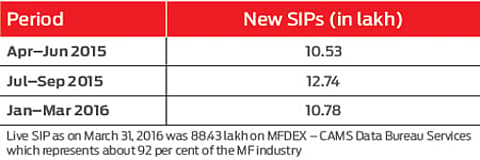

The awareness has also meant that investors have continued to stay invested in equity mutual funds, despite nothing very great happening in the Indian markets. The equity mutual fund assets as on March 2016 stood at Rs 3.45 lakh crore with Rs 4,438 crore coming this April alone. The data on MFDEx CAMS indicates 44.87 lakh new SIPs were registered through FY16. The combined industry AUM in the past one year has gone up from Rs 11.86 lakh crore to Rs 14.22 lakh crore. What is heartening to note is that a majority of this addition is coming through regular SIP investments.

The average SIP is about Rs 3,000 a month, which means at least Rs 3,000 crore is finding its way into the industry under its varied offerings. The additions despite a year when the Sensex actually ended in the red, is indicative of how AMCs, IFAs and other intermediaries have managed to hand-hold investors through the benefits of investing through SIPs in the long run. The power of compounding as the base to understand the advantage of SIPs along with linking investing with financial goals have all collectively worked in ensuring investors stay invested in the markets irrespective of stock market movements.