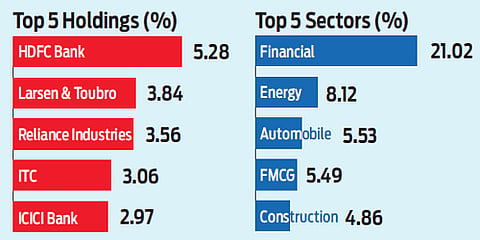

One look at this fund’s performance of beating its benchmark by huge margins and you know why we call it consistent. This balanced fund has a dependable long-term track record to go by. This fund typically allocates about 70 per cent of its assets to equities, with the rest in debt. With the investment philosophy to purchase reasonable-quality businesses, when seen from the perspective of growth, ROE, management quality, and business dynamics, without compromising on valuations.

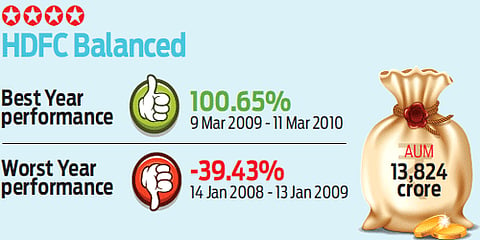

Consistent performer: HDFC Balanced

This fund typically allocates about 70 per cent of its assets to equities, with the rest in debt

Advertisement

The fund manager also manages to contain the downside risk when the markets are low, which has been repeatedly demonstrated over the past 17 years of this fund’s history, especially in both 2008 and 2011. At the same time, when the markets are up, this fund’s performance is comparable to any diversified equity fund. The performance track record is also evident in the manner this fund’s corpus has swelled in recent years.

Launch Date: August 10, 2000

Fund Manager: Chirag Setalvad

Benchmark: Crisil Balanced Fund Aggressive Index

Expense ratio: 1.95

Show comments

Published At: