Gold Prices

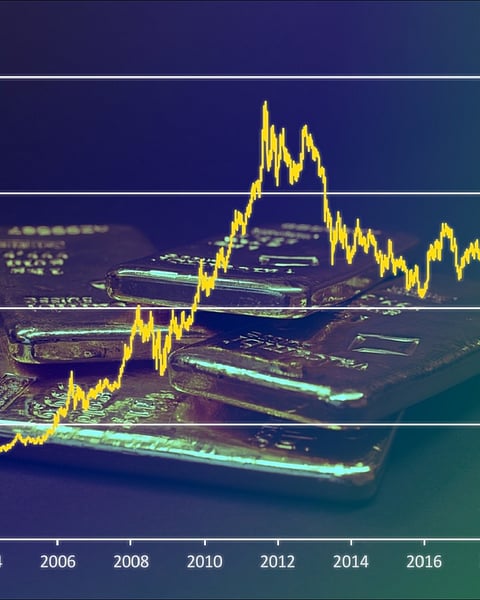

Gold prices are impacted by a variety of variables which include market circumstances, supply and demand dynamics and economic policies.

Gold prices are impacted by a variety of variables which include market circumstances, supply and demand dynamics and economic policies.

Gold price on the global market scale is primarily established in the London bullion market. The London Bullion Market Association (LBMA) with national organizations connected to several governments throughout the globe, sets the price of gold. Twice a day, at 10:30 AM and 3 PM GMT prices are set.

Spot Price is the price at which gold is bought and sold for immediate payment and delivery. While Futures Price is agreed upon in futures contracts, where participants commit to buying or selling gold at a predetermined price on a future date.

1. Import Costs: In India, import costs have big impact on the ultimate selling price. The spot price for gold is the amount of 24-carat gold set in London per ounce, plus the import expenses such as shipping and handling fees.

Taxes like Goods and Services Tax (GST) and import duties, which can vary and directly impact the final price paid by consumers are imposed by the government of Indi. Changes in these regulations can lead to sudden price fluctuations.

Gold demand in India often increases during festivals and wedding seasons, driving prices higher. Conversely, poor agricultural yields can decrease demand and lower prices.

Both domestically and internationally, economic and political decisions can also influence gold prices. For instance, new regulations on gold imports or reduced production from gold-exporting countries can significantly impact pricing.