Mutual funds are investment products that operate on the principle of ‘strength in numbers’. At a rudimentary level, a mutual fund is an investment vehicle, which pools money from investors with common investment objectives. They collect money from a large group of investors, pool it together, and invest it in various securities, in line with their objective. This way, they are an alternative to investing directly, which is more convenient yet no less rewarding. The novelty extends to their working also, in the kind of investment exposures they offer, the terms they use, the norms for pricing they follow, and lots more.

For instance, if you were to invest in stocks on your own, you would need to know at the very least how to analyse and track companies, the ways of the market, and the intermediaries who will help you buy and sell shares. A mutual fund that invests in stocks relieves you of all such hassles, while giving you the same investment exposure. All in all, a mutual fund is a handy investment option for individuals handicapped by a lack of investing acumen or time, or generally disinclined to take charge of their personal finances.

A mutual fund is managed by one or more professional managers. Fund managers on a day-to-day basis decide when to buy and sell investments according to the investment objectives of the fund. Each fund’s investment portfolio is de-signed to achieve specific objectives and typically, portfolios contain several different stocks, bonds and other securities. The composition of each portfolio varies according to the fund’s investment objectives and the level of risk permitted. Likewise, each fund scheme will have a minimum investment that you need to make and a lock-in period. Your exit from the scheme comes at a cost known as exit load.

So, when you invest money in a mutual fund, you receive some units of the fund. Each unit represents a proportionate component in the fund’s portfolio. And the value of your mutual fund units will fall and rise depending upon the performance of the securities in the portfolio. The units are available to you at the net asset value (NAV) of the security at the time of purchase, switch or redemption. Mutual funds report their NAV daily, which represents the mutual fund’s assets minus its liabilities. NAV will fluctuate with changes in the market value of the mutual fund’s particular investments. You can redeem your investments in a fund scheme or opt for an investment option where you are paid a dividend.

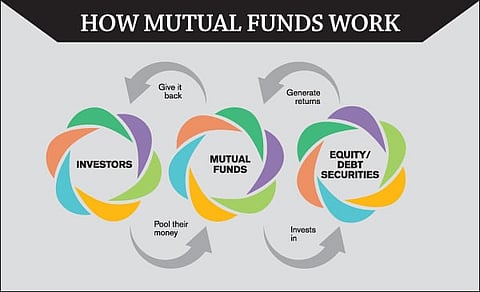

The working of Mutual Funds

Mutual funds operate on the principle of pooled resources

Advertisement

Show comments

Published At: