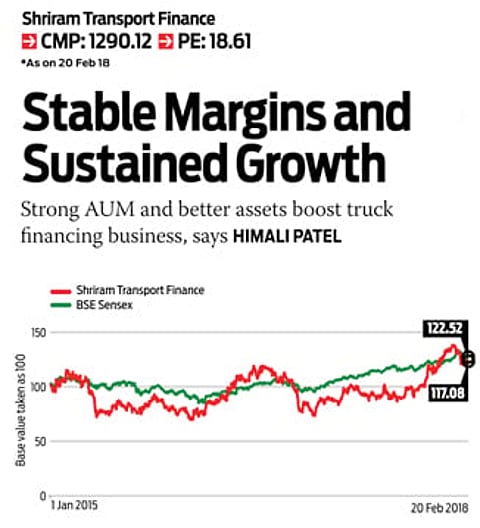

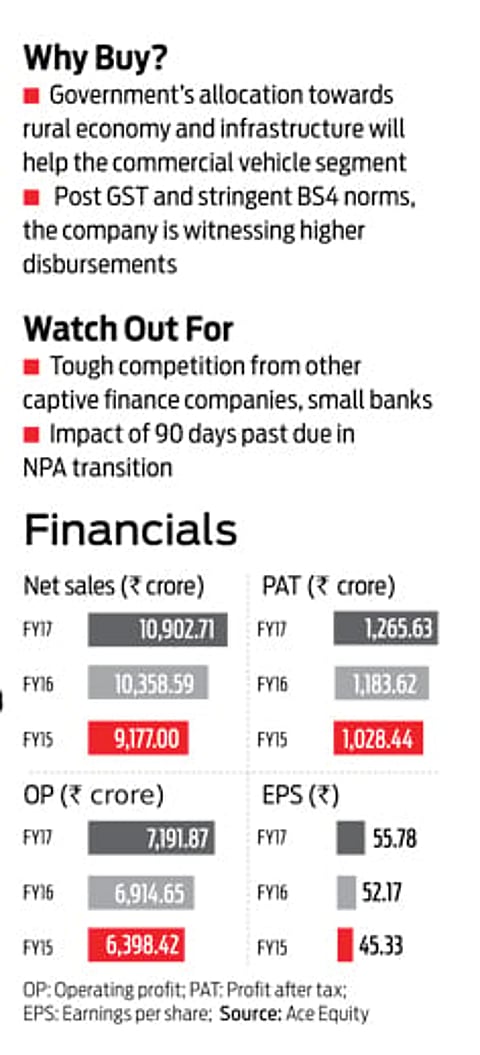

Shriram Transport Finance Company (STFC) showcased a strong performance in the third quarter of FY18, helped by strong Assets Under Management (AUM) growth and better asset quality. What has tilted the balance in favor of the company is its approach towards the under-penetrated market for second-hand truck financing.

Stock Pick

Strong AUM and better assets boost truck financing business, says HIMALI PATEL

The company has been able to capture this segment by becoming a leader in the organised financing of pre-owned trucks with a strategic presence in the five and ten-year-old segment. Established in 1979, this non-banking finance company (NBFC) is the flagship company of the Shriram Group. It has a pan-India presence with a network of 1,121 branches and tie-ups with more than 500 private financiers.

Rural focus

For Q3 FY18, AUM grew by 18 percent year-on-year (Y-o-Y) to `90,018 crores against `76,281 crores in the previous corresponding period. Net interest income (NII) rose by 21.5 percent to `1,709 crores against `1,012 crores in the previous period. “Rural continues to be a focus area with higher branch additions and improvement in AUM mix to 31 percent vs 29 percent in Q2 FY18. The management sees a further mix increase,” Prabhudas Lilladher says in its research report.

The management expects its AUM to grow to an estimated `1,100 billion by the end of FY19. For Q3 FY18, the gross non-performing Asset (GNPA) stood at 7.98 percent and net non-performing asset (NPA) at 2.45 percent Y-o-Y. “Better asset quality with higher provision coverage ratio (PCR) and sustained growth momentum will keep the stock buoyant,” points out an analyst at HDFC Securities in a report.

The company’s disbursement grew by 64.7 percent Y-o-Y, aided by strong growth in new commercial vehicle (CV) financing and a healthy growth in the used CV segment. “Strict implementation of the overloading ban, pickup in construction and infra activities, and better rural demand led to robust disbursement growth of approximately 65/8 percent Y-o-Y/Q-o-Q,” HDFC Securities reported.

AUM growth, stable margins, and declining credit cost have led to better profits, which increased by 43.26 percent Y-o-Y to `495.63 crores against `345.96 crores in the previous year. Brokerages such as HDFC Securities, Prabhudas Lilladher and ICICI Direct have given a ‘buy’ call on the stock.

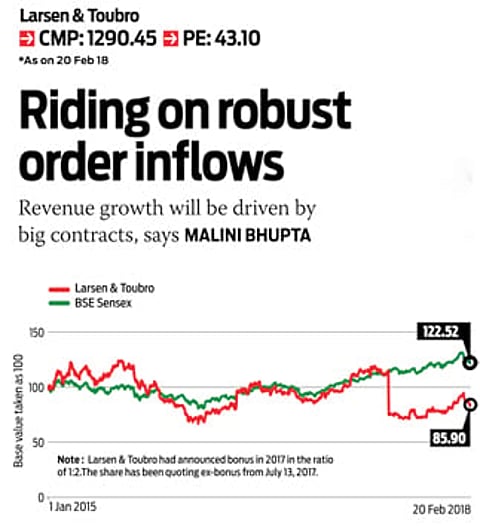

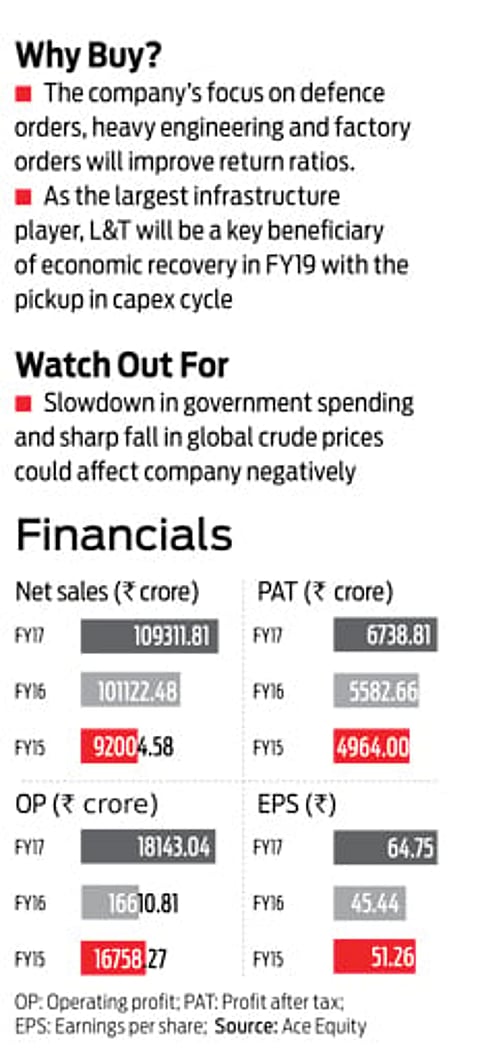

For any infrastructure company, new order inflows and execution of existing orders determine how the company will fare. On both counts, Larsen & Toubro seems to be on a firm wicket. The company reported an order inflow growth of 71 percent Y-o-Y in the December quarter of the current fiscal. In the first six months of FY18, order inflows declined by nine percent to `55,100 crores. But there are clear signs of a recovery in the second half of the year, and the next year is expected to be even better. Brokerage firm Jefferies pegs the potential of fresh order inflows at $19 billion in FY19. The brokerage believes that the domestic order flow growth will set the stage for L&T’s engineering and construction margin recovery. This will be further supported by domestic execution.

Expected deals

In the December quarter, L&T posted an 11 percent growth in infrastructure revenues. Domestic infrastructure revenue growth hit a six-quarter high at 20 percent, despite the challenges in the real estate sector. Even heavy engineering and hydrocarbons reported a healthy revenue growth in the quarter, suggesting a broader recovery in the economy and investments in infrastructure. Edelweiss Securities expects L&T’s earnings to grow at 18 percent CAGR in FY17-20 estimates. The brokerage is factoring in 150 basis points jump in margins and 14 percent growth in execution, both far from cyclical peak levels.

The Street expects the company to win a raft of orders: $3 billion from defense (Landing Platform Dock), $2 billion from railways (Dedicated Freight Corridor) and $12 billion from defense (Tactical Communications Systems) in FY19. The company’s revenue growth will be driven by execution of large orders in FY18 and FY19. Motilal Oswal Securities is building in a revenue growth of eight percent for FY18 against a guidance of 10-12 percent. Despite the slowdown in execution after the rollout of GST, L&T’s execution has improved in the December quarter.

Analysts also expect the company’s net working capital to remain at 20 percent of sales in the near future, given the time is taken to process input credit under the new GST regime. Under its strategic plan called Lakshya, the company proposes to bring down its net working capital to 18 percent of sales by FY21. Overall, L&T will be a key beneficiary of the uptick in CapEx cycle, believe analysts.