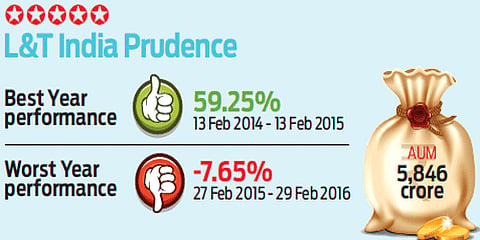

A relatively new fund, launched in 2011, in this short period has managed to create a reputation of a dependable performer. However, the fund is yet to test a period of downturn, but in the indifferent 2013 and 2015 years, it did manage to hold on to its performance. This fund’s objective is to generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related securities.

Prudent player: L&T India Prudence

Launched in 2011, in this short period the fund has managed to create a reputation of a dependable performer

Advertisement

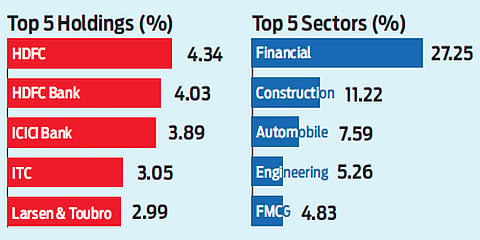

The equity portfolio has no market capitalisation restriction and at the same time, the portfolio is tightly maintained with about 50 well diversified stocks. The fund manager invests in stocks with value orientation as a theme based on a company’s business model, financial parameters, and business expectations. On the debt component, the fund manager takes an active view of the interest-rate movements supported by macros. This fund is a good selection for investors looking for a fund with stable returns.

Launch Date: Jan 31, 2011

Fund Managers: Shriram Ramanathan, Soumendra Nath Lahiri and Karan Desai

Benchmark: S&P BSE 200 Index (70%) Crisil Short-Term Bond Index (30%)

Expense ratio: 2.01

Show comments

Published At: