The past 18 months have proved to be a watershed for the Indian pharma industry. Long touted as a defensive bet with sound business models and cash-rich companies, the sector has witnessed a robust rise in stock prices and valuations with promising EPS (earnings per share) growth. But since pharma most stocks have entered their fair valuation zone, does the sector have in it to sustain the performance for the long run? Let’s dissect the sector step by step

Indian pharma: In the pink of health?

Breaking the numbers to find out whether the sector has the stamina for the long haul or not.

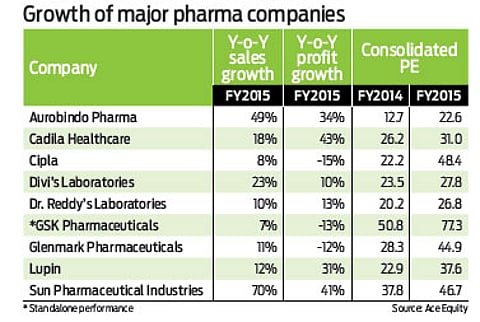

Hard numbers Many large-cap pharma companies, such as Sun Pharmaceutical, Dr. Reddy’s Laboratories, Lupin, Aurobindo Pharma and Ajanta, among others, have risen as much as 46.4 per cent, 30.9 per cent, 86.8 per cent, 226 per cent and 276 per cent, respectively, from January 1, 2014 till June 15, 2015. Same is true for several mid-and small-cap companies, such as Torrent, Alembic, Strides Arcolab, Granules India and Abbott India over the same period.

The National Stock Exchange (NSE) pharmaceutical index, for instance, is trading at a PE of 51 times as on June 16, 2015, as against the PE of 39.93 witnessed on the same day in 2014. From local buyouts and cross border mergers and acquisitions to private equity investment, the sector has witnessed it all. In the past few years, a few big ticket mergers and acquisitions have also taken place, alongside private equity deals, driving growth and valuations.

Wheels of the wagon The US market has been the big growth driver for Indian companies and that trend is likely to continue. Overall, India’s

share in the global pharma segment should continue to rise, driven by exports growth. According to a report by CARE Ratings, the US accounts for about 25 per cent of the total Indian Pharma Industry (IPI) exports. Given that the overall share of exports in IPI’s turnover is around 53 per cent, the US market contributes around 13-14 per cent to the industry’s total turnover. The US remains the most important market and is the reason Indian pharma companies have witnessed a stupendous growth in the last 5-7 years.

That said, as a whole, India still accounts for a mere 7 per cent of the US generic drug market. However, as far as capability is concerned, Indian companies have a very healthy abbreviated new drug application (ANDA) pipeline compared to global players.

During January-May 2015, the USFDA granted 158 ANDA approvals (excluding tentative approvals), of which 56 approvals have been for Indian companies.

Indian pharma companies are now increasingly looking to build a sustainable footprint beyond the Indian and the US generic markets. Geographies of interest are Africa, which shares a similar market structure like India, as well as Latin America and the CIS countries (commonwealth of independent states). Some of the Indian companies like Dr. Reddy’s, Ranbaxy and Torrent have had a long-standing presence in these markets. The interest in these regions is now, however, much more broad-based.

Risks and impediments

Regulatory issues emanating from the recent US FDA actions against a number of Indian companies, including those related to pointing out manufacturing deficiencies, warning letters and finally, import alerts, which essentially ban import of drugs into the US from specific plants, remains a concern.

Says Suruchi Jain, equity research analyst, Morningstar Investment Adviser: “Changes to foreign regulations are hard to comply with on an ongoing basis for those companies selling abroad. The other risk is price competition from existing incumbents which could erode profits, especially in the non-innovator or generics space.”

On the domestic front, the increase in scope of price regulation remains a threat. Changes to pricing policies have impacted several Indian pharma players over the last two years. Companies like Ranbaxy, IPCA and Wockhardt have seen serious impact on performance on account of regulatory issues.

Also, exports to less-regulated markets could have a negative impact. These could be countryspecific issues like the ones witnessed in Russia where the currency depreciated sharply on back of its dependence on oil exports.

Should you bet? According to experts, another reason for high valuations of many pharma stocks is the FII preference in many of these stable growth engines, with little to no earnings surprises. Says Jain: “Valuations should continue to remain high with FII interest in India at its peak. At a company level, however, some stocks may appear overvalued while others may look from undervalued to fairly valued.”

So, the ideal picks would be those with a strong domestic franchise (chronic or specialty products), proven R&D capabilities, interesting US pipeline and, neat balance sheets and cash flows.

Coming to the Indian market, India’s spend on drugs is among the lowest compared to the top-15 markets. The yearly per capita spend has been $60-64 (between 2010 and 2014) as per the World Bank. As the per capita income continues to grow, disposable income is likely to go up and the per capita spend on drugs is set to increase. Says Meeta Shetty, pharma analyst, Kotak Securities: “We do not expect yearly per capita spending to swell up to over $100 immediately, but we foresee a steady 13-14 per cent CAGR over the next five years. Indian players have not only built a good pipeline for the next 2-3 years with healthy ANDA filings, but are also preparing for beyond three-year horizon.”

Going forward, the overall revenue growth for the sector is expected to be high; however, the growth could also be as a result of a number of investment opportunities in companies that have invested in pipelines and have the ability to reap the benefit of operating leverage.