NCDs (Non-Convertible Debentures) are a debt instrument that cannot be converted into equity or stock and has a fixed tenure.

What Are NCDs? What Are Its Interest Rates? Should You Invest In NCDs?

NCDs are not convertible debentures issued by corporates. Majorly NBFCs are the largest raisers of the fund through the NCD route and very few supply from manufacturing companies in this space.

NCDs have a fixed maturity date and the interest can be paid along with the principal amount either monthly, quarterly, or annually depending on the fixed tenure specified. There are mainly two types of NCDs- listed NCDs, and unlisted NCDs.

Mukesh Kochar, national head of wealth at AUM Capital said, “Interest rates of NCD depend on the rating of the underlying issuer along with the Tenure. AAA-rated NCDs will give lower rates compared to an AA or below and so on. The interest rates vary from eight per cent-13 per cent tentatively depending on the criteria I just mentioned.”

Feature and Risks of NCDs

Feature of NCDs

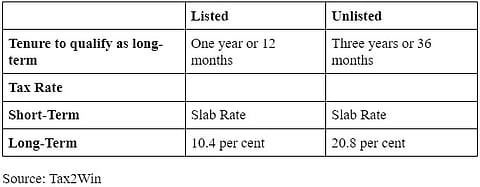

1. Taxation: NCDs carry tax implications depending on the tax bracket the investor falls under.

If NCDs are sold within a year, STCG will be applicable as per the income tax slab rate.

If the NCDs are sold after a year or before the maturity date, LTCG will be applicable at 20 per cent with indexation.

The interest income from NCDs is taxed similarly as fixed income securities under ‘income from other sources.

2. Credit rating- Companies are ranked by credit rating agencies such as CRISIL, CARE, etc. To determine the potential of a company, its rating plays a major role.

3. Interest - NCDs may offer a high interest rate ranging from seven per cent to 10 per cent if held till maturity. The interest rates vary based on the ratings of the NCDs. E.g. - A highly rated NCD may offer between seven to nine per cent whereas risky NCDs offer a return in the range of 10-13 per cent. Interest payouts are either monthly, quarterly, half-yearly, or annually. NCDs do offer a cumulative payout option, as well.

4. Liquidity- NCDs are generally listed securities hence one can sell them in the secondary market before maturity. One could look at different interest payout options offered by NCDs such as monthly, quarterly, half‐yearly, or annual interest payments.

Risks of NCDs

Credit Risk: The credit risk in NCDs refers to default risk associated with the non-payment of interest or the principal amount as promised. This risk is higher for NCDs issued by companies with lower credit ratings. Sometimes the ratings provided by the credit rating agencies may not truly capture the risks involved in the NCDs.

Interest rate risk: If the interest rate hike, it affects adversely the market value of NCD. So, there is an inverse relationship between the interest rate and the market value of NCDs.

Liquidity Risk: This is the risk associated with being able to exit from the debenture at fair value within a reasonable time.

Should You Invest in NCDs?

“If someone has a risk appetite then he can be considered investing in these NCDs but in this case, one should not invest in very long-tenure NCDs. As it is very difficult to predict the financial healthiness of an organization over a long period. Historically we have seen many NCDs have defaulted. So chasing higher returns can be risky. One should maintain the basic principle that invest in debt to protect the capital and grow at just over the inflation rate and should invest in equity if looking for a double-digit kind of number and not in NCDs giving such high returns,” Kochar said.

According to experts, one can consider investing in NCDs but one should understand the risk parameters including security cover, ratings, tenure, profitability, balance sheet, future outlook, interest rate outlook, etc. before considering investment into NCDs.

AAA NCDs will have very low risk compared to A-rated security. Also, many new small NBFCs are offering very attractive rates in the range of 10-13 per cent which is attractive but risky.

Chirag Muni, Associate Director, Anand Rathi Wealth said “Today an AAA-rated corporate NCD would offer yield in the range of 7.5 per cent - 8.5 per cent. A 10-year government paper is available around 7.2 per cent. The difference in return is not so significant for one to switch from a government paper to a corporate NCD as the liquidity risk in corporate NCD is relatively high.”

“AA or A-rated NCDs would offer yields upwards of 10 per cent but at the same time, it faces high credit risk as well as liquidity risk. We would not suggest investing in the high-yielding NCD as well because rather than taking a single issuer credit risk and liquidity risk for a 10 -11 per cent return one is better off investing in equity. Equities too over a longer tenor can offer 12 per cent - 14 per cent return,” Muni said.