A new survey has found that India's savings have stagnated in 2023. The survey provides valuable insights into how Indians save and invest. The findings suggest that there is a growing preference for mutual funds, but that savings bank accounts remain the most popular financial product. The survey also highlights the importance of saving for emergencies and other financial goals.

India's Savings Have Stagnated in 2023, More Indians Prefer Mutual Funds Over FDs, Finds Survey

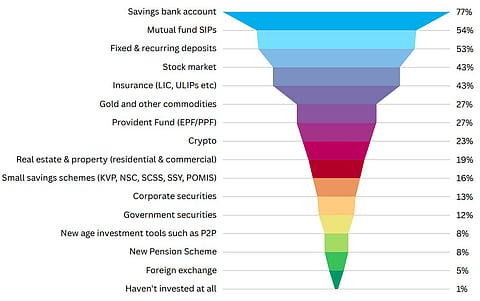

Mutual funds continue to be the investment of choice for Indians, followed by fixed deposits. However, a majority of people still prefer to park their capital in savings bank accounts.

The survey, which was conducted by BankBazaar, an online marketplace for financial products in India, found that 47.3% of respondents reported that their savings dipped in 2022, but this number reduced to 41.7% in 2023. Despite the slight improvement, the survey found that savings have stagnated for a larger percentage of people. Compared to 2022 when 32.1% reported no change in their savings, the number has risen to 37.0% in 2023.

The survey also found that mutual funds continue to be the investment of choice for Indians, followed by fixed deposits. However, a majority of people still prefer to park their capital in savings bank accounts. The survey's findings are likely due to a number of factors, including inflation, the war in Ukraine, and the ongoing COVID-19 pandemic. These factors have made it more difficult for many people to save money.

Gender Split:

- More men (79%) chose savings bank accounts than women (76%).

- Mutual funds were preferred by more men than women across age cohorts.

- Fewer women chose riskier investments, such as cryptocurrency, this year compared to men.

Key Findings:

- Mutual funds are the preferred investment for 54% of respondents, followed by fixed deposits (FDs) at 53%.

- Savings bank accounts are the most popular financial product, with 77% of respondents using them.

- Savings have either reduced or stagnated for 41.7% of respondents in 2023.

- The top reasons for saving are emergencies (61%), children and inheritance (58%), and lifestyle upgrades (45%).

Regional Differences:

- Pan India, savings have declined for a majority of the respondents, but not as significantly as they did last year.

- The North came in first with the highest drop, of 44%, followed by the East and West, both of which stood at 42%.

- The South reported the lowest drop in savings, at 40%.

Despite the challenges, the survey also found that there are some positive trends. For example, the number of people who are saving for emergencies has increased. In addition, the number of people who are investing in mutual funds has also increased.

The survey's findings are important for a number of reasons. First, they highlight the importance of saving money. Second, they provide insights into the investment habits of Indians. Third, they can help policymakers to develop programs that can help people to save more money.

(All Graphics from BankBazaar Survey)