Share.Market, a PhonePe product, brings forth the Intelligence Layer on Stocks - an in-depth quantitative factor-based analysis of each stock, a first-of-its-kind in the discount broking industry. The intelligence layer integrated with the product feature and execution layer ensures that investors are provided with comprehensive wealth solutions in a DIY mode within the discount broking framework.

Navigating the complexities of the stock market and making informed decisions can be daunting for investors especially when faced with intricate data analysis, such as understanding a stock's fundamentals or monitoring its price movements. Share.Market’s Intelligence Layer eliminates this need. Instead, investors can rely on its comprehensive factor-based analysis to make their decisions with confidence.

This Intelligence Layer empowers investors in multiple ways:

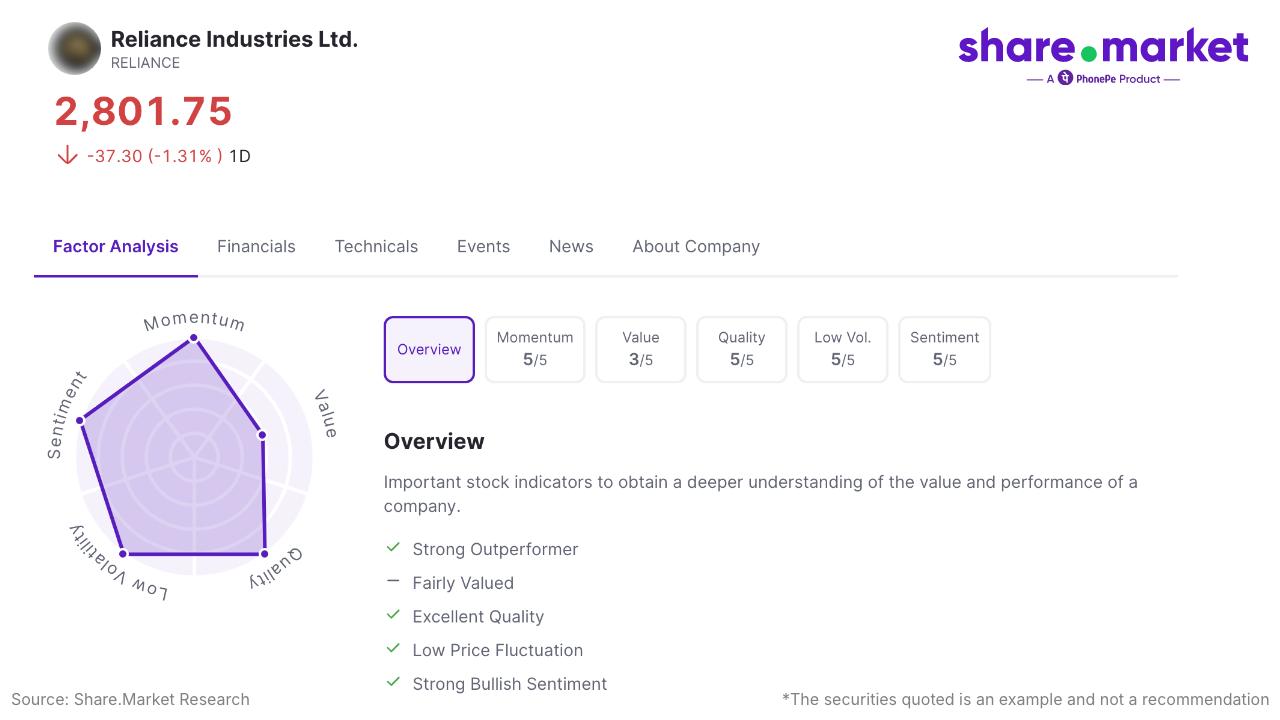

• Factor-based Analysis: They gain access to quant-based research on all stocks at no additional cost. By evaluating stocks across five key factors — quality, value, momentum, volatility, and sentiment — investors can assess each stock's potential and suitability for their portfolio.

• Comparative Insights: Investors can also compare a stock's factor scores with those of its peers, enabling them to make nuanced investment decisions.

• In-depth Collections Research: They can analyze stocks featured in Share.Market’s WealthBaskets or Stock Collections, gaining valuable insights into why these selections were made, enhancing their understanding.

• Larger Universe of Stocks: While traditional full-service brokers offer research, their scope is limited to a select number of stocks. However, Share.Market encompasses all listed stocks with published data within its universe, bridging the gap in research, being within the discount broking framework.

Reflecting on this innovative development, Ujjwal Jain, CEO, Share.Market, said, “We are redefining discount broking by shifting the focus from transactional processes to comprehensive wealth solutions. Factor analysis was always embedded into our WealthBaskets and Collections products and by bringing it onto individual stocks, we have now made it accessible to all investors in a consumable format. By providing actionable intelligence in a user-friendly format supported by educational content, we anticipate higher increased engagement on the platform as well.”

Launched last year, Share.Market, with Zero A/c Opening Fee, offers a wide spectrum of investment products such as stocks (intraday and delivery), Mutual Funds, Exchange-Traded Funds (ETFs), and WealthBaskets, allowing investors across different demographics to build a well-rounded and balanced portfolio. Additionally, for a limited duration, Share.Market is also offering Zero Brokerage on cash delivery and intraday, and Zero Brokerage on F&O.

Website: https://share.market

Download the App:

About PhonePe Wealth Broking: PhonePe Wealth Broking Private Limited, incorporated in April 2021 is a subsidiary of PhonePe Private Limited and is registered with NSE and BSE as a Stock Broker, with CDSL as a Depository Participant with SEBI as a Research Analyst and with AMFI as a Mutual Fund distributor. Launched in August 2023, Share.Market, a brand of PhonePe Wealth Broking and affiliates, is a wealth and investment platform (app & website), catering to investors and traders of all expertise levels. The platform offers a wide range of investment products, including Stocks, Mutual Funds, WealthBaskets, and more.

About PhonePe Group:

PhonePe Group is India’s leading fintech company. Its flagship product, the PhonePe digital payments app, was launched in Aug 2016. In just 7 years, the company has scaled rapidly to become India’s leading consumer payments app with 530+ million registered users and a digital payments acceptance network of 39 million merchants. PhonePe also processes 250 million daily transactions with an annualized Total Payment Value (TPV) of USD 1.5+ Trillion.

On the back of its leadership in digital payments, PhonePe Group has expanded into financial services (Insurance, Lending, Wealth) as well as new consumer tech businesses (Pincode - hyperlocal e-commerce and Indus App Store - India's first localized App Store). PhonePe Group is an India headquartered technology company with a portfolio of businesses aligned with the company's vision to offer every Indian an equal opportunity to accelerate their progress by unlocking the flow of money and access to services.

For more details, contact: media@share.market

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”

All investors are advised to conduct their own independent research into investment strategies before making an investment decision.

Brokerage will not exceed the SEBI prescribed limit.

WealthBasket is not a Exchange Traded Product and it would not have access to Exchange Investor Redressal Forum or Arbitration Mechanism.

PPWB acts as a distributor of mutual funds. MF is not an Exchange traded product. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism.

Disclaimer: PhonePeWealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Registered Office Address: Office - 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Bellandur Village, Varthur Hobli, Outer Ring Road, Bangalore South, Bangalore , Karnataka – 560103, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst– INH000013387 and ARN- 187821. Member id : BSE - 6756 NSE 90226. CIN U65990KA2021PTC146954 “Registration granted by SEBI, and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.”